Disbursements from different marketplaces (EU) how to recognize?

We get disbursements into our bank accounts from multiple EU marketplaces (same seller account). It is really confusing during book-keeping to tell which disbursement is from which marketplace.

All disbursements have unique IDs but nothing traceable to marketplace name. Also, the disbursement emails mention nothing about marketplace. Just some generic ‘disbursement attempted’ message without mentioning marketplace.

All this causes unnecessary work during book keeping because you have to look back in each marketplace to see all disbursements and identify which is which.

Do you have this problem? How are you dealing with it?

submitted by /u/summer_glau08

[link] [comments]

Shouldn’t have added Canada and Mexico to my Americas market

Does anyone have any experience with this because I’m at a standstill. Originally I only had my seller account for US, then one day I saw that I could easily add Mexico and Canada. I thought sure, why not? Then about 8 months ago, I was notified that I had to add credit card info so Amazon could bill me monthly for the ability to sell to Mexico (approx. $35 per month) There is no way I want to do that, because I doubt I would even sell much in Mexico, and could never recoup that monthly fee. Then I found there was no way to remove those Americas once you add them. Since I refused to updated my credit card info for the Mexico billing, Amazon froze my seller account across all Americas and now my books can be seen, but show as unavailable. It just so weird to have rules change, that completely shut out a seller. Any clues as to what I can do?

submitted by /u/Short-Pattern4898

[link] [comments]

Shouldn’t have added Canada and Mexico to my Americas market

Does anyone have any experience with this because I’m at a standstill. Originally I only had my seller account for US, then one day I saw that I could easily add Mexico and Canada. I thought sure, why not? Then about 8 months ago, I was notified that I had to add credit card info so Amazon could bill me monthly for the ability to sell to Mexico (approx. $35 per month) There is no way I want to do that, because I doubt I would even sell much in Mexico, and could never recoup that monthly fee. Then I found there was no way to remove those Americas once you add them. Since I refused to updated my credit card info for the Mexico billing, Amazon froze my seller account across all Americas and now my books can be seen, but show as unavailable. It just so weird to have rules change, that completely shut out a seller. Any clues as to what I can do?

submitted by /u/Short-Pattern4898

[link] [comments]

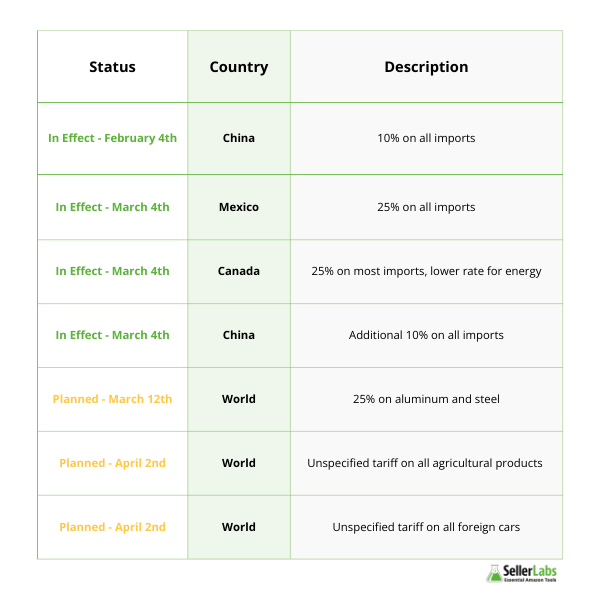

New Tariffs in 2025: What Amazon Sellers Need to Know

The U.S. government has announced significant tariff increases on imports from key trading partners, including Canada, Mexico, and China. These changes, effective March 4, 2025, will impact various industries—including Amazon sellers who depend on international suppliers.

Understanding how these tariffs will affect product costs, supply chains, and pricing strategies is crucial for staying competitive. In this guide, we’ll break down the new tariffs and provide actionable strategies to help Amazon sellers navigate these changes.

What Are the New Tariffs?

The latest tariff changes impose additional taxes on a wide range of imported goods. Here’s a breakdown of the key updates:

According to The Times, these new tariffs mark one of the most significant shifts in U.S. trade policy, particularly affecting North American and Chinese imports. The increased tax burden is expected to have widespread consequences for e-commerce businesses, including Amazon sellers.

How Will These Tariffs Affect Amazon Sellers?

If you source products or raw materials from Canada, Mexico, or China, these tariffs could significantly impact your business in the following ways:

1. Higher Costs on Imported Goods

Amazon sellers who import inventory from affected countries will see a direct increase in costs. Many private-label sellers source products from Chinese manufacturers, meaning the 20% tariff will raise expenses and squeeze profit margins.

2. Changes to the De Minimis Rule

Previously, the de minimis rule allowed duty-free imports for shipments under $800. However, recent changes may lower this threshold, meaning more shipments will be subject to tariffs and customs duties. This could increase administrative work and raise costs for sellers relying on smaller imports.

3. Supply Chain Disruptions

With tariffs on materials like steel and aluminum, manufacturing costs are expected to rise, impacting the availability of key products. Additionally, AP News reports that Mexico, Canada, and China are considering retaliatory tariffs, which could further complicate supply chains for Amazon sellers. If suppliers raise prices or shift production locations, sellers may face delays and unexpected expenses.

4. Pricing Pressure & Competitive Shifts

If sellers increase prices to offset higher costs, they risk losing customers to competitors who source from tariff-free regions. On the flip side, some sellers may benefit if competitors struggle with cost increases.

How Amazon Sellers Can Prepare for These Changes

To stay profitable despite these new tariffs, consider these strategies:

1. Diversify Suppliers & Manufacturing Locations

Sourcing from alternative countries not affected by these tariffs (such as Vietnam, India, or Taiwan) could help reduce import costs. Look for suppliers who offer competitive pricing outside of China, Mexico, and Canada.

2. Optimize Inventory Management

With potential delays and increased costs, it’s critical to fine-tune inventory planning. Consider tools that help forecast demand and adjust stock levels accordingly to avoid unnecessary overstocking or stockouts.

Pro Tip:

The Seller Labs Restock Tool calculates the exact number of units needed based on sales trends and current inventory. Sellers can input their target days of stock to ensure they don’t over-purchase expensive inventory due to tariffs or run out of stock at a crucial time.

3. Review Pricing Strategies

While price increases may be necessary, avoid sudden, drastic changes. Test incremental price adjustments and monitor competitor pricing to stay competitive.

4. Monitor Trade Policy Updates

Tariff policies can change quickly. Staying informed will help you adapt to new regulations, potential tariff rollbacks, or government exemptions.

5. Check Harmonized Tariff Codes

Make sure you’re using the correct Harmonized Tariff Schedule (HTS) codes to classify your imports properly. Some products may qualify for lower tariffs under different classifications.

Pro Tip:

The Seller Labs Pro Dashboard consolidates key metrics, helping sellers track costs and financial performance. This ensures they can react quickly if a tariff increase makes certain products unprofitable.

The newly imposed tariffs are creating challenges for Amazon sellers who rely on imported goods. However, with strategic planning—such as supplier diversification, pricing adjustments, and inventory optimization—sellers can mitigate some of the impact.

Staying informed and adapting to changes will be crucial in 2025. If you haven’t already, now is the time to assess your supply chain, explore alternative sourcing options, and refine your pricing strategy to maintain profitability in this new trade environment. Seller Labs offers data-driven insights to help sellers make smarter decisions in response to these changes.

Want to stay ahead of the competition?

Try Seller Labs today and take control of your Amazon business!

The post New Tariffs in 2025: What Amazon Sellers Need to Know appeared first on Seller Labs: Amazon Seller Software and Platform.

Commercial liability insurance policy for non-us citizen

I got this mail from Amazon so i need to find some insurance company. I read about Next and Marsh, i contacted them borh but there is no answers after 3 days.

I am located on European soil (Serbia), i dont have LLC in US.

Can anyone recommend some insurance that can help me, i contacted few of them in Serbia but they are not doing this

Any help would be great

submitted by /u/rugbyrep

[link] [comments]

Commercial liability insurance policy for non-us citizen

I got this mail from Amazon so i need to find some insurance company. I read about Next and Marsh, i contacted them borh but there is no answers after 3 days.

I am located on European soil (Serbia), i dont have LLC in US.

Can anyone recommend some insurance that can help me, i contacted few of them in Serbia but they are not doing this

Any help would be great

submitted by /u/rugbyrep

[link] [comments]

Amazon Refunded Buyer Without My Consent – Now They Likely Have My Item Too. Does Amazon even care about sellers?

Hey everyone,

I sell on Amazon (not FBA), and I recently had a buyer from Italy claim they never received their order. Tracking shows it was delivered, but they insisted it never arrived.

Without my consent, Amazon refunded them immediately—no questions asked. Now I’m out both the product and the money. The buyer likely has both.

Has anyone dealt with this before? Is there anything I can do to challenge this or prevent it from happening again? It feels like Amazon just takes the buyer’s side automatically.

Would appreciate any advice!

submitted by /u/Leather_Step_3741

[link] [comments]

Do you recommend selling more than one niche?

I’ll be registering my private label in a couple of days, but in Europe you gotta decide a class for what you want to sell. My first intention was to sell pet products like cat scratching boards, dog collars etc.

My first product is gonna be pet hair brush which is gonna be in class n21 (if I’m not wrong), where there are other things like sponges or cleaning utensils.

I thought: “if I’m already registered for selling those things, why not?” Do you recommend selling also those products? Or will it just ruin my label?

(Additionally cat scratching boards are in class n28 together with sport products… I will register to that class too, but don’t know if selling running shoes with pet supplies is even a good choice)

submitted by /u/ZexitoD

[link] [comments]

Do you recommend selling more than one niche?

I’ll be registering my private label in a couple of days, but in Europe you gotta decide a class for what you want to sell. My first intention was to sell pet products like cat scratching boards, dog collars etc.

My first product is gonna be pet hair brush which is gonna be in class n21 (if I’m not wrong), where there are other things like sponges or cleaning utensils.

I thought: “if I’m already registered for selling those things, why not?” Do you recommend selling also those products? Or will it just ruin my label?

(Additionally cat scratching boards are in class n28 together with sport products… I will register to that class too, but don’t know if selling running shoes with pet supplies is even a good choice)

submitted by /u/ZexitoD

[link] [comments]

Amazon Refunded Buyer Without My Consent – Now They Likely Have My Item Too. Does Amazon even care about sellers?

Hey everyone,

I sell on Amazon (not FBA), and I recently had a buyer from Italy claim they never received their order. Tracking shows it was delivered, but they insisted it never arrived.

Without my consent, Amazon refunded them immediately—no questions asked. Now I’m out both the product and the money. The buyer likely has both.

Has anyone dealt with this before? Is there anything I can do to challenge this or prevent it from happening again? It feels like Amazon just takes the buyer’s side automatically.

Would appreciate any advice!

submitted by /u/Leather_Step_3741

[link] [comments]