How to Optimize Your Cost per Acquisition (CPA) Rate

It costs money to attract customers. As a result, sellers should understand how much money to allocate for acquiring new buyers and re-targeting existing ones. This is why cost per acquisition (CPA) is one of the most important metrics in ecommerce.

Calculating and optimizing CPA can be a challenging task. Sellers use multiple channels to increase visibility, and it can be difficult to identify the best ones to ensure you don’t waste marketing dollars.

Plus, you can apply CPA to the entire customer journey, but it is crucial to understand at which point your investment resulted in a conversion. Here’s how to calculate and optimize cost per acquisition.

What Is Cost Per Acquisition (CPA)?

Cost per acquisition (CPA) is a metric used to calculate the cost of acquiring a new customer. It’s a standard metric used in digital marketing, but all business niches can use it, including ecommerce companies.

Why CPA Is Important for Sellers

Businesses can approach CPA in different ways. In ecommerce, sellers often gauge how much revenue is generated from various marketing tactics, like advertising and search traffic.

All businesses must invest money to earn it back, but you also don’t want to spend more than what you earn. This is why cost per acquisition is essential to your finances.

In short, CPA ensures the money you spend toward marketing and advertising is driving revenue. Calculating your CPA also helps you not overspend while analyzing campaign performance.

You can also use CPA to measure the performance of individual campaigns. If you’re starting a new sponsored products campaign, you can measure the revenue impact versus your investment to gauge whether the campaign was effective.

CPA vs Similar Metrics

There are several metrics similar to cost per acquisition, but they differ in various ways. Two key metrics in this context are customer acquisition cost (CAC) and customer lifetime value.

Customer Acquisition Cost

Customer acquisition cost (CAC) refers to the amount a business spends to convert a potential buyer into a customer.

CAC is used to calculate the total cost of all sales and marketing efforts aimed at attracting new customers. In contrast, CPA is used to test the profitability of a specific campaign.

Lifetime Value

Customer lifetime value (CLV) also measures the profitability of a single customer, but it also measures the profitability across the entire customer relationship.

This metric is more complex to track because it encompasses your entire product inventory, varying costs, as well as purchase volumes and frequencies, in addition to marketing, advertising, and retention expenses.

ROAS

Return on ad spend (ROAS) calculates the revenue you earn from your advertising campaign. Like CPA, it’s a channel-specific metric, but ROAS strictly measures the amount you earn from advertising, not organic marketing.

Using Cost Per Acquisition

Which channels and strategies are the best fit for the CPA metric? Here are a few examples:

- Advertising. PPC can drive your conversion rates by generating immediate attention and awareness. That said, this strategy requires a higher upfront cost.

- Social media. Having a powerful social media presence is essential for all businesses, especially in ecommerce. More social media channels are allowing “shopping” on each platform, which means your traffic can translate into sales.

- Influencer marketing. This tactic is beneficial since sellers can increase brand awareness without a massive investment.

- Content marketing. While creating content is affordable, it can be challenging to calculate the revenue you earn from this strategy. That’s because content marketing encompasses multiple channels, including your blog and social media platforms.

Cost Per Acquisition Formula

Here’s how to calculate cost per acquisition: divide the amount spent on a specific platform by the number of customers gained from that channel.

Let’s say you host an Amazon SEO campaign and you spend $500. The campaign attracted 50 new customers. You’ll divide 500 by 50 to get a $10 CPA

That said, calculating CPA isn’t always this simple. You must be sure that a particular channel attracted those customers.

In reality, a prospective buyer may have discovered your brand from another platform or even word of mouth, and it’s impossible to know when the conversion occurred.

What’s a Good and Bad CPA?

There is no universal “good” or “bad” CPA. Instead, every seller should set their benchmarks depending on their operating costs, profit margins, sales goals, and profits.

For example, what if your CPA is $10, but every order was worth at least $15? This means you made a profit. However, if every customer spends less than $10, that means your costs exceed your revenue.

Sales between customers also vary; one customer may have purchased an item for $8, but the following order can be worth several hundred dollars. Maybe the customer who purchased one $8 item may return and buy more items.

Sellers must also consider other order types, such as subscriptions.

How to Optimize Cost Per Acquisition

Is there a way you can improve your CPA? Absolutely! Here are a few best practices.

- Know your audience. Understand what your buyers expect from you and your products.

- Know your competitors. Conducting a competition analysis will inform you of your strengths and weaknesses compared to your biggest competitors.

- Personalize your messaging. Tailor your content and ads to target each stage of the user journey and address pain points as they arise.

- Track acquisitions. Pay attention to sales from new customers as they come in. This ensures your marketing dollars are being used for a purpose. If your costs exceed your revenue, you have the opportunity to find ways to lower them.

Best Practices When Optimizing CPA

While cost per acquisition is a beneficial metric, it can be difficult to track. Here are the best practices when optimizing your campaign with CPA:

- Set goals. Always establish marketing and sales objectives that align with a high CPA. This way, you can ensure you have a quality and cost-effective marketing campaign that results in higher sales.

- Gather insights per channel. Evaluate your CPA and other relevant metrics on each individual platform. This way, you’ll know which channel is delivering the best results.

- Track historical CPA. Cost per acquisition isn’t a one-and-done metric. Seasonal trends and events can lead to a surge in sales. Understand when these busy seasons occur so you can sustain a larger marketing budget.

- Anomalies can happen. Don’t be discouraged if you’re noticing a low CPA. Sales drops can occur, but this also means you may need to reassess your strategy or investigate potential issues.

Tools to Optimize CPA

The key to a healthy CPA score is continually tracking, testing, optimizing, and refining your strategy while working to lower costs. Here are a few tools that can help with this:

- Customer relationship management. CRMs offer insight into your customers and any leads that are interacting with your brand.

- Sales funnel optimization. These tools ensure you have a solid sales funnel. You can use this tool to visualize your unique funnel and automate buyer’s journey tracking for each lead.

-

- Conversational AI. Chatbots and other types of conversational AI can engage buyers across multiple channels, boosting sales and conversions.

- Sales forecasting. These tools predict trends by collecting data and insights in real-time. This can help you forecast seasons with higher sales, which in turn assists with budgeting.

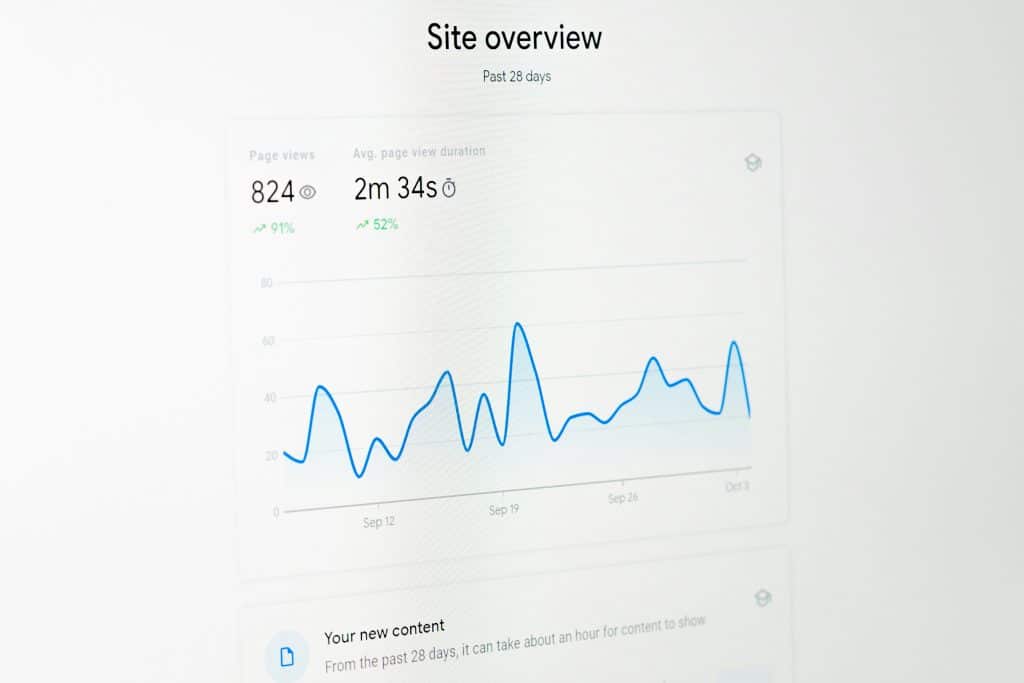

- Analytics platforms. This technology tracks various metrics on your website and social media pages, such as traffic and impressions, which can help you gauge how many leads you’re converting from organic marketing efforts.

Are You Still Struggling With a Low CPA?

Brands can’t achieve high sales and repeat customers without investing. Oftentimes, that investment is in marketing and advertising. To ensure your marketing dollars are paying off, many sellers track key metrics, such as cost per acquisition.

What if you have a low CPA, or you’re investing more than what you’re getting back? When you work with us, you’ll have a dedicated team that will create a personalized sales strategy tailored to your needs.

Author

Stephanie Jensen has been writing ecommerce content for seven years, and her copy has helped numerous stores rank on Amazon. Follow her on LinkedIn for more insight into freelance writing and creating high-quality content.

Stephanie Jensen has been writing ecommerce content for seven years, and her copy has helped numerous stores rank on Amazon. Follow her on LinkedIn for more insight into freelance writing and creating high-quality content.

The post How to Optimize Your Cost per Acquisition (CPA) Rate appeared first on AMZ Advisers.