How to Calculate Your Customer Acquisition Cost (CAC)

Getting new customers isn’t cheap. Between ad spend, sales team salaries, and the cost of software, the bill adds up fast. Enter the concept of customer acquisition cost (CAC), which isn’t just a marketing number, but a financial reality check.

If you’re spending more to land a customer than they’re worth, your growth will stall no matter how great your product is.

Let’s unpack what customer acquisition cost is and how it compares with related metrics like cost per acquisition and lifetime value. We’ll also look at strategies on how you can optimize CAC so you can get more out of every buck you spend.

What is Customer Acquisition Cost?

CAC is the sum of all resources spent to successfully bring a new customer into your business. It’s a core metric in any customer acquisition strategy, especially for companies that rely heavily on digital marketing and direct-to-consumer (DTC) models. It’s not just about the act of getting new customers but also about how much it costs to make that happen.

Understanding the cost of customer acquisition is especially critical for ecommerce businesses, where profit margins are often razor-thin and marketing teams are lean.

Knowing your CAC in relation to industry norms can help you evaluate whether your spending is aligned with actual returns. In fact, many businesses use CAC as a key performance indicator (KPI) to track the efficiency of their sales and marketing operations.

To get a better sense of where your CAC stands, competitive benchmarking is key. Take a look at how CAC varies across ecommerce industries as per data from First Page Sage:

These figures, derived from competition analysis using internal data from over 80 clients between 2020 and 2025, provide a realistic view of what businesses typically spend per customer.

Whether you’re following the statistics above or other data from various sources, benchmarks offer a useful lens for measuring how your customer acquisition cost stacks up within your niche.

How to Calculate Customer Acquisition Cost

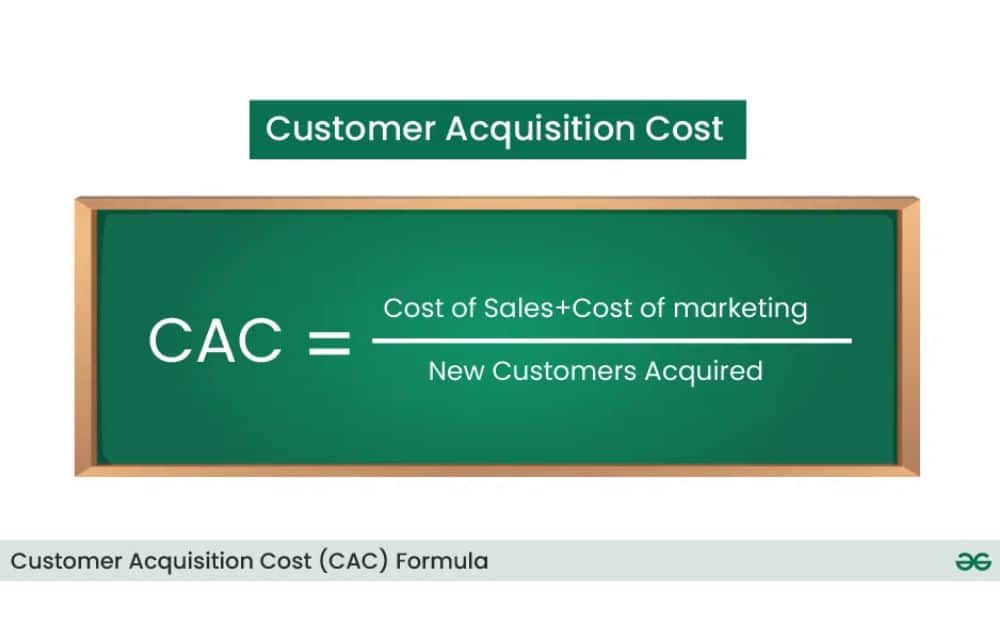

Understanding your customer acquisition cost starts with a simple but powerful formula. It shows you how much you’re spending, on average, to convince someone to become a paying customer.

Here’s the basic customer acquisition cost formula:

CAC = Total Sales and Marketing Costs ÷ Number of New Customers Acquired

Let’s break that down. Sales and marketing costs can include everything you spend to get sales, such as:

- Ad spend

- Agency fees

- Software subscriptions

- Salaries of sales and marketing teams

- Content production costs

Note, however, that customers acquired refers only to paying customers, not leads or email subscribers. Say your business spent $20,000 on marketing and sales for the month and gained 400 new customers—that puts your CAC at:

$20,000 ÷ 400 = $50 CAC

The computation above shows you need $50 for one customer.

A healthy customer acquisition system is built on more than just calculating costs; it also requires having a solid sales funnel in place. Without one, you might spend more and convert less, leading to higher CAC and lower ROI.

When your funnel is optimized, your acquisition cost goes down while your conversion rate goes up. So before blaming high CAC on your ad budget, take a look at how well your sales funnel is doing its job.

CAC vs CPA: Knowing the Difference

Though sometimes used interchangeably, CAC and Cost Per Acquisition (CPA) are not one and the same.

So, what’s the key distinction? CAC accounts for all costs associated with acquiring new customers, from initial marketing efforts to final sales conversions.

In contrast, CPA tracks the cost of a specific action―like a click, app install, email signup, or even a lead form submission. CPA typically used in performance marketing to monitor campaign efficiency.

Think of CAC as the big-picture cost of growth, while CPA focuses on micro-conversions along the way.

If your CPA is $12, you’re paying $12 for each lead. However, these leads are not yet paying customers.

When only one in 10 leads turns into a customer, it means you have to bring in 10 leads just to make one sale.

So the math is: $12 (per lead) × 10 leads = $120

Therefore, your CAC is $120. You’re essentially spending $12 ten times before you land one actual customer. That’s why CAC ends up being $120, not just $12.

This highlights why relying solely on CPA can be misleading, especially if your ultimate goal is revenue and paying customers, not just generating activity or interest.

However, tracking both helps you:

- Understand how your customer acquisition funnel is performing

- Spot gaps where leads drop off before converting

- Fine-tune your customer acquisition strategy for better ROI

CAC vs. LTV: The Balance to Watch

When evaluating how much to spend on acquiring customers, knowing your CAC is only half the equation. LTV, or Customer Lifetime Value, estimates the revenue you can earn from a customer throughout their journey with your company.

The formula for LTV is:

Average Purchase Value × Purchase Frequency × Customer Lifespan = LTV

Here’s what each part means:

- Average Purchase Value. the typical dollar amount a customer spends during a single purchase.

- Purchase Frequency. How many times, on average, a customer buys from you within a set period (such as annually.)

- Customer Lifespan. The average duration a customer continues doing business with you, usually measured in years.

Let’s say the average order is $50 and a customer buys four times a year, with the average customer sticking around for three years.

The computation would be: $50 × 4 × 3 = $600

In this scenario, the customer’s lifetime value would amount to $600.

So, what’s the ideal balance between LTV and CAC? Most businesses aim for an LTV:CAC ratio of at least 3:1. That means if you spend $100 to acquire a customer, you should ideally earn $300 or more from them over time.

If your ratio is 1:1, you’re breaking even. If it’s lower, you’re losing money.

Strategies to Optimize CAC

Here are a few strategies you can implement to optimize CAC, along with actionable tips and free customer acquisition tools you can use:

Refine Your Targeting

A broad audience might get you clicks, but that doesn’t always translate to sales. Casting a wide net often means reaching people who aren’t ready or even interested in buying. This leads to wasted ad spend and a higher CAC.

According to WordStream, the average Google Ads conversion rate across all industries is about 4.4%, but advertisers who fine-tune their targeting and keyword strategy can see rates as high as 7.98% or more in top-performing industries like vehicles.

When your ads reach people with the right intent, you pay less for each conversion, stretch your budget further, and ultimately grow smarter.

- Actionable Tip. Use lookalike audiences on Facebook Ads or keyword refinement in Google Ads to focus on high-intent segments.

- Free Tool. Google Ads Keyword Planner – ideal for spotting low-cost keywords that drive conversions

Related content: Amazon Keyword Targeting

Invest in Content Marketing

Content marketing may not deliver instant results, but it’s one of the most cost-effective ways to reduce customer acquisition cost over time.

Content helps build brand trust and demonstrate expertise. Plus, it executes well with SEO best practices, boosting your ranking and visibility. Instead of paying for every click through ads, create high-value resources that attract and convert your ideal audience organically.

- Actionable Tip: Build a content calendar focused on keywords your customers actually use. Create SEO-driven blog posts, FAQs, and downloadable resources (like checklists or templates) that answer real questions

- Free Tool: Ubersuggest – discover high-volume, low-competition keywords and blog topic ideas.

Consult Experts Who Know Your Platform

If you’re selling on Amazon, working to reduce CAC isn’t as straightforward as lowering your ad spend. Many sellers waste thousands on inefficient campaigns simply because they don’t fully understand how Amazon’s ecosystem works.

That’s where working with a team of platform-specific experts like AMZ Advisers makes all the difference.

We specialize in building tailored strategies that optimize both paid and organic acquisition channels, reducing CAC and boosting LTV for Amazon sellers. Book a Free Strategy Call to evaluate your current Amazon customer acquisition strategy.

The Lowdown

Customer acquisition cost is a reflection of how efficiently your business grows. If you’re spending more to gain a customer than they’re worth, you’re bleeding budget.

But when you know how to calculate CAC, track it properly, and optimize each stage of your customer acquisition strategy, you give your business the power to grow profitably and predictably.

Author

Carla Bauto Deña is a journalist and content writer producing stories for traditional and digital media. She believes in empowering small businesses with the help of innovative solutions, such as ecommerce and digital marketing.

Carla Bauto Deña is a journalist and content writer producing stories for traditional and digital media. She believes in empowering small businesses with the help of innovative solutions, such as ecommerce and digital marketing.

The post How to Calculate Your Customer Acquisition Cost (CAC) appeared first on AMZ Advisers.